ISO 20022 and ISO 20022-Compliant Cryptocurrencies

How To Buy and Swap Ixinium (XXA) — Watch Step by Step Videos!

01. – How to set up a LOBSTR app

02. – How to buy XLM

03. – How to swap XLM to XXA

04. – How to trade XXA

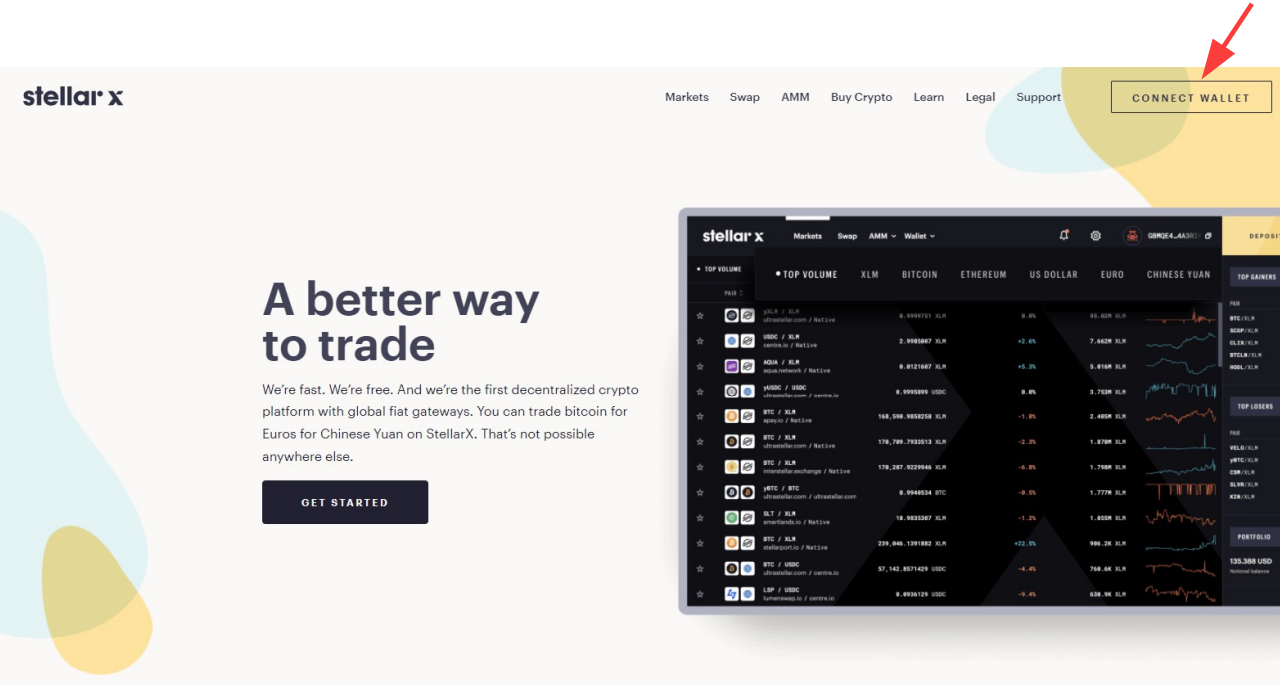

1. Go to the StellarX page https://www.stellarx.com and select CONNECT WALLET

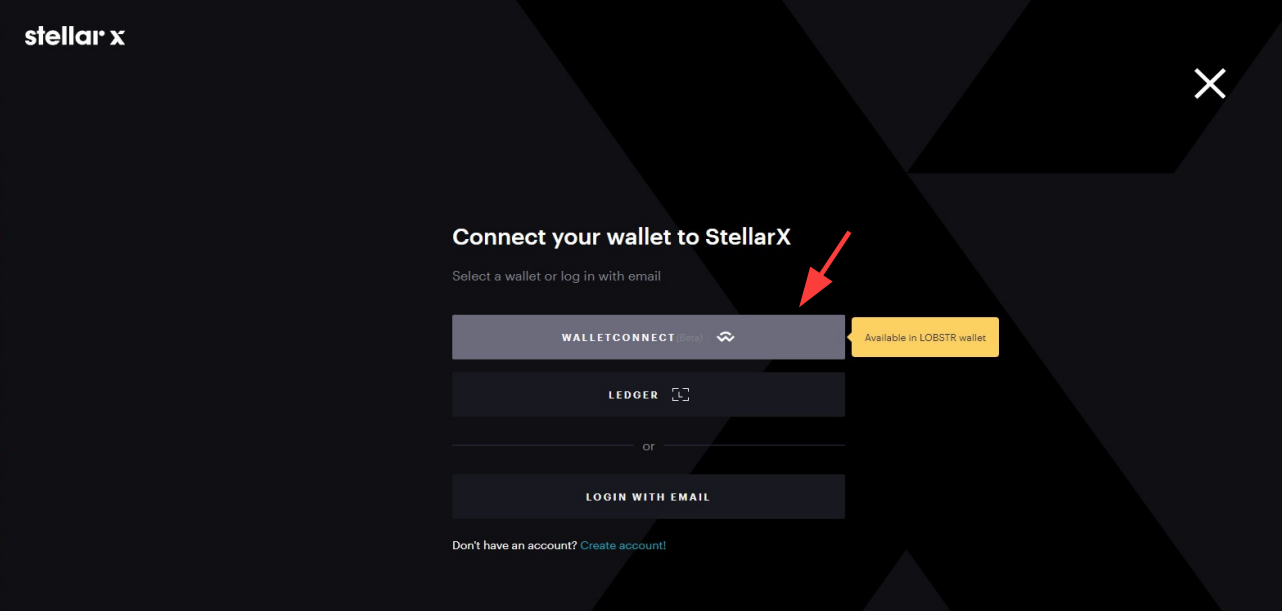

2. Select WalletConnect login option

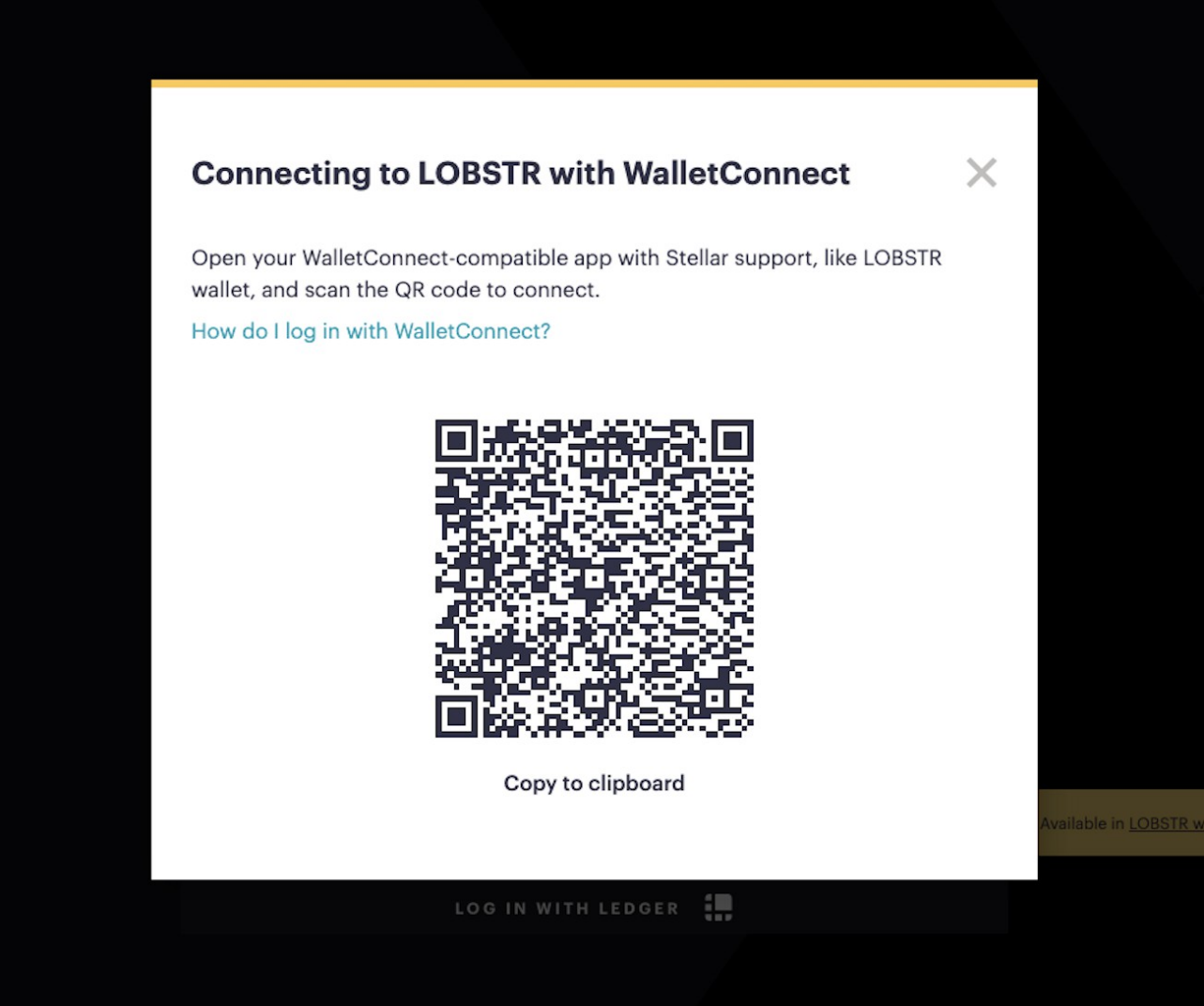

3. The Scan QR code pop-up will now appear. Next, you need to scan the displayed QR code from your LOBSTR application to connect StellarX with your wallet on LOBSTR.

4. Open the LOBSTR app on your mobile device.

If you do not yet use LOBSTR you can get the app from either the Apple or Google Play stores:

● Download on the App Store (link: https://apps.apple.com/us/app/lobstr-stellar-wallet/id1404357892)

● Grab it on Google Play (Link: https://play.google.com/store/apps/details?id=com.lobstr.client?

Once you have the LOBSTR app, you will need to either sign up or log in to your LOBSTR account. If you’re a new user to LOBSTR you can create a new Stellar Wallet or connecting one you already use to your account.

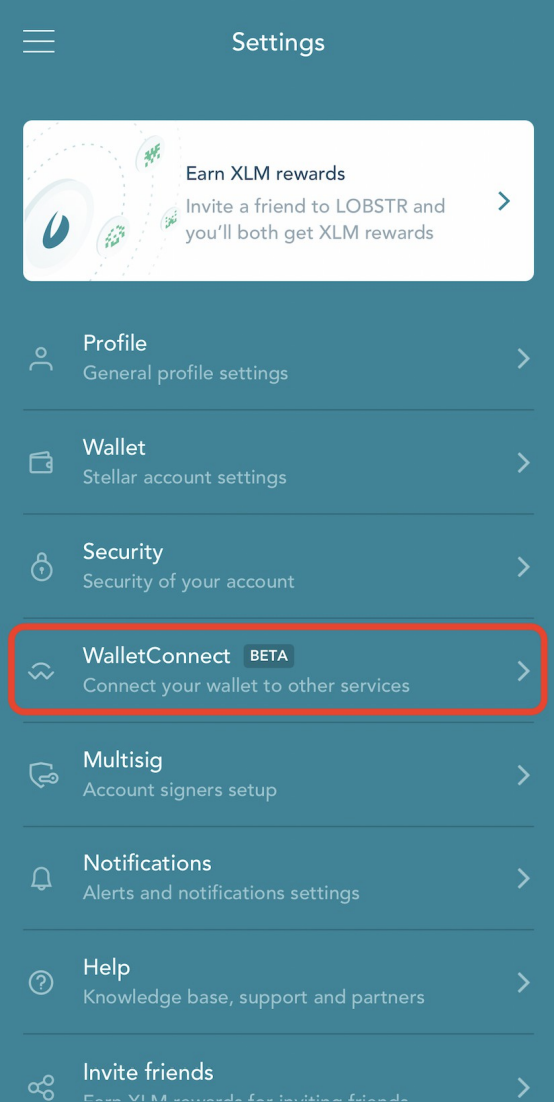

5. Navigate to the menu ≡ icon in the top left corner, click Settings, then choose WalletConnect from the menu.

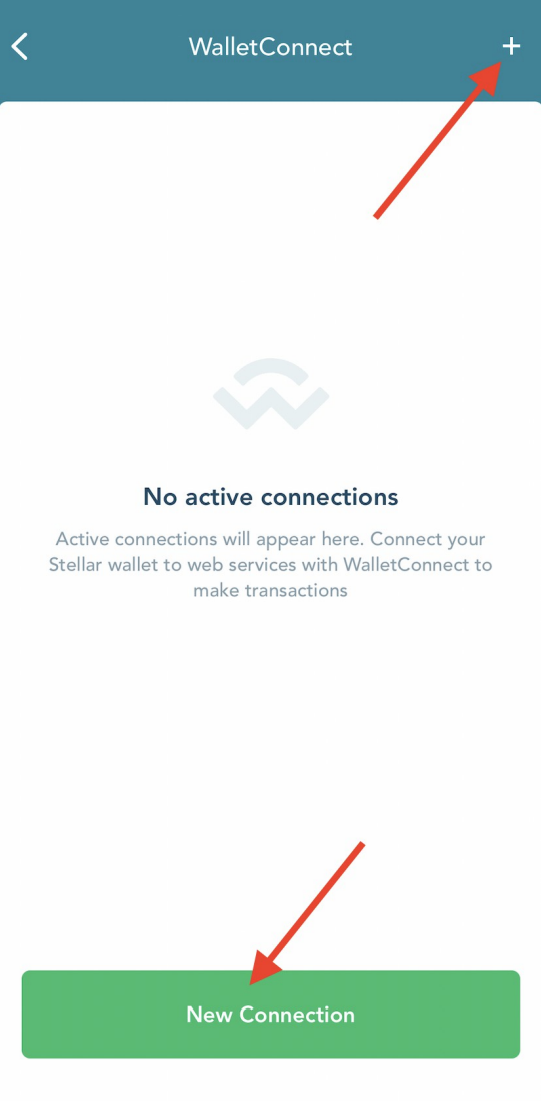

6. Click the + button in the top right or the New Connection button to open up the camera and scan the QR code given to you by StellarX.

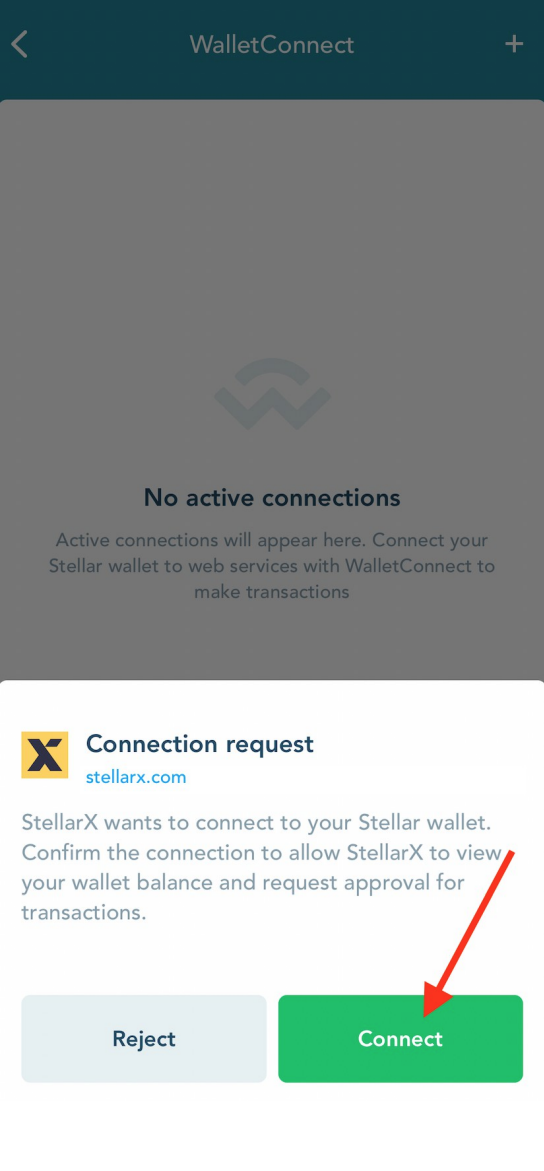

7. Confirm the connection in LOBSTR app

You will now see a Cancel/Confirm notification on the LOBSTR app. If you press Cancel the session will be canceled. If you press Confirm then StellarX will log in with your Stellar Wallet from LOBSTR.

You are now logged with your Stellar Wallet from the LOBSTR app. From here you can now use StellarX the same way as any other log in option. Every time you make an action in your wallet, like making a payment or creating an offer, you will now be asked to confirm the transaction in the LOBSTR app.

By confirming the transaction in LOBSTR app, you sign this transaction using the secret key of your Stellar Wallet from the LOBSTR app. This means your private key stays safely in your LOBSTR app, without the need for it to be put directly into StellarX.

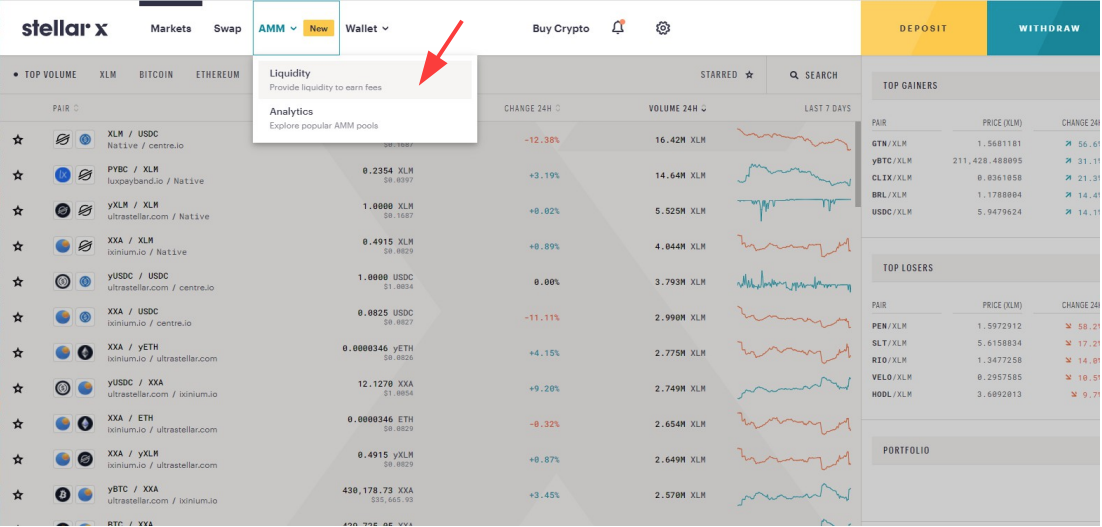

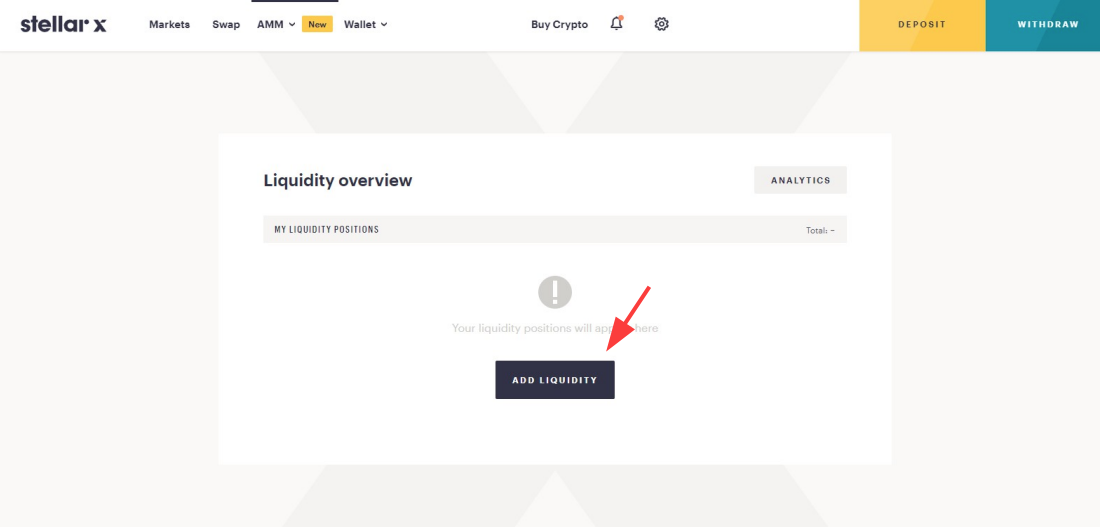

8. Add XXAs to the Stellar liquidity pool. Go to the AMM->Liquidity

9. Go to the ADD LIQUIDITY

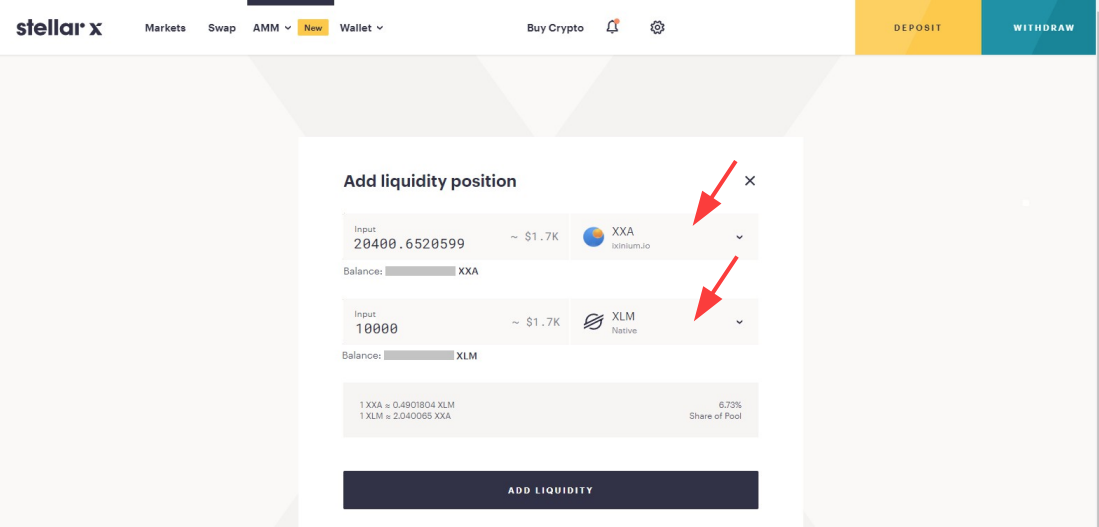

10. Select XXA to the first token and XLM to the second token. Choose the amount of the XXA you want to put into the XXA/XLM liquidity pool and the needed XLM amount will come automatically.

Or

You can choose the amount of the XLM you want to put into the XXA/XLM liquidity pool and the needed XXA amount will come automatically.

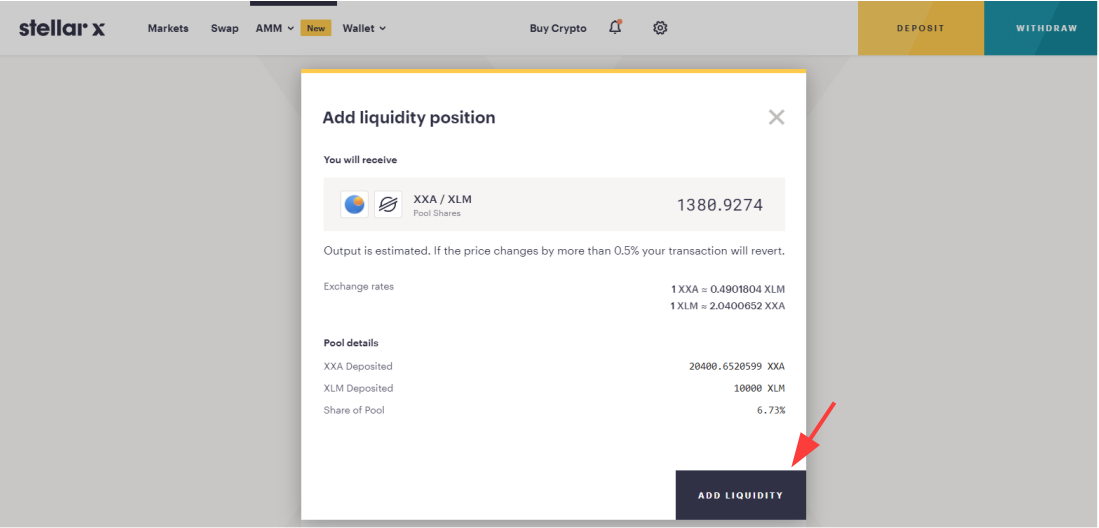

11. Go to the ADD LIQUIDITY

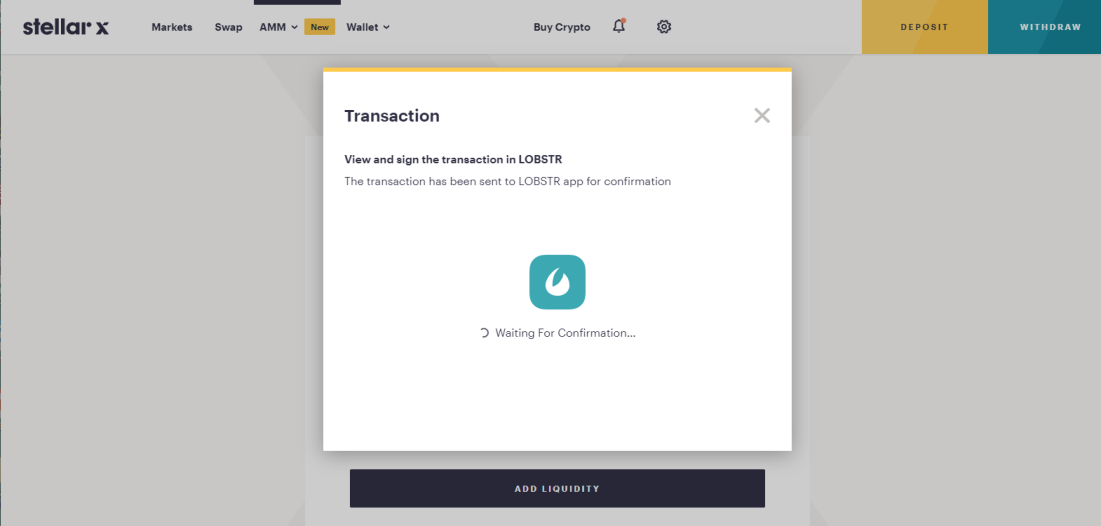

12. Confirm and sign the transaction on your LOBSTR app.

After the successful confirmation, you have successfully participated XXA liquidity pool.

There are many different XXA pools with different interest ratios and more liquidity pools coming. We hope you enjoy this new and interesting way of using Ixinium XXA.

Ixinium XXA buyback program is in the beta-testing phase. Currently, it’s active from Monday to Friday, while during the weekends we check the data logs and order setting functionality.

Buyback is fully automated, using a market buy order to buy a certain amount of XXA from the lowest market sell order position available. There’s no locked-price for buy order function. Whatever the XXA/XLM current lowest market sell order is, automation uses that XXA/XLM pair price to buyback order.

XXA’s from the buyback program stays in at the account, which is part of Ixinium’s digital portfolio account. Buyback XXA’s won’t return back to the market circulation. This is our way to support the XXA’s market price.

Ixinium XXA, nro#5 rated token on the Stellar network.

While being the MOST TRADED TOKEN, nro#1, on the Stellar network of the all +19,000 Stellar tokens!

https://stellar.expert/explorer/public/market?sort=trades24h

After several emails included screenshots and links to prove Ixinium XXA’s market position, daily volume on the Stellar network, and exchanges, we finally got an answer for the https://coinmarketcap.com/currencies/ixinium/ issue of the wrong daily volume, missing market cap, and circulation supply.

Above is the screenshot of their answer, which shows their level of interest for us after swiping off the market cap, and circulation supply several months ago. We can’t complain, at least after several complaints, we finally got the answer to our latest complaint.

As they answered: “If the information checks out, they may process an update” . Even though every provided information is correct, proofed and all the links provided and explained, they may fix something or not, never know…

Official exchange partner of the Ixinium XXA. Stellar DEX trading with the first-class Token Swap.

The Ixinium team has applied CertiK auditing for the Ethereum XXA code couple of weeks ago.

Auditing with vulnerability report and preliminary comments are now made. There are a couple of things to be modified/updated, so The Code is back in the coder’s workshop to be developed in the way described on the CertiK audit report.

After the modification, The Code will be sent back to the CertiK for a new audit.

Ixinium XXA liquidity pool/-s for the Ethereum network is scheduled to launch on the UniSwap V3 only after the CertiK audit report shows that The Code is OK.

On the 24th of August 2021, the Ixinium Foundation has purchased 128.0 grams of Gold. The latest Ixinium Foundation portfolio allocation report:

Customer No. 143026

compiled on 24/08/2021 at 11:01:11

PORTFOLIO

Securities account No: UK-2312178-R

Gold 76.1543 g

Palladium 31.3636 g

Platinum 77.4516 g

Silver 5,046.7478 g

Securities account No: UK-232877-E

Gold 268.0000 g

Ixinium Asset Token (IXAT)

On the 24th of August 2021, 11,115 IXAT tokens have been minted. IXAT is a Stellar blockchain-based

Ixinium Asset Token. When Ixinium Foundation purchases Precious Metals, the same USD amount of

IXAT tokens will be minted.

Precious Metals purchase (EUR) = 9,500.00

EUR-USD exchange rate= $1.17

IXAT minted amount= 11,115 IXAT

IXAT total supply= 34,262 IXAT

Asset name: IXINIUM ASSET

Asset code: IXAT

Issuer address: GCSECMDTZDHAUCTZJO4Z3BGAGDKKV77TBGPBWPOAJUE6Z5N5JEU4CY4R

Current account: GCPKKAAJTXXRDFPRZ63HUTYXYVSFNMAITFNEZELSZEWFMFMRH6HSEWSH

Stellar network explorer: https://stellar.expert

Ixinium Foundation

A3, Bel Etang,

Hermitage Mont Fleuri,

Mahé Seychelles

Reg.No 000882

On the 27th of August 2021, the Ixinium Foundation has purchased 12,150.0000 grams of Silver. The latest Ixinium Foundation portfolio allocation report:

Customer No. 143026

compiled on 27/08/2021 at 12:30:07

PORTFOLIO

Securities account No: UK-2312178-R

Gold 76.1543 g

Palladium 31.3636 g

Platinum 77.4516 g

Silver 5,046.7478 g

Securities account No: UK-232877-E

Gold 268.0000 g

Silver 12,150.0000 g

Ixinium Asset Token (IXAT)

On the 27th of August 2021, 11,174 IXAT tokens have been minted. IXAT is a Stellar blockchain-based

Ixinium Asset Token. When Ixinium Foundation purchases Precious Metals, the same USD amount of

IXAT tokens will be minted.

Precious Metals purchase (EUR) = 9,500.00

EUR-USD exchange rate= $1.1762

IXAT minted amount= 11,174 IXAT

IXAT total supply= 45,436 IXAT

Asset name: IXINIUM ASSET

Asset code: IXAT

Issuer address: GCSECMDTZDHAUCTZJO4Z3BGAGDKKV77TBGPBWPOAJUE6Z5N5JEU4CY4R

Current account: GCPKKAAJTXXRDFPRZ63HUTYXYVSFNMAITFNEZELSZEWFMFMRH6HSEWSH

Stellar network explorer: https://stellar.expert

Ixinium Foundation

A3, Bel Etang,

Hermitage Mont Fleuri,

Mahé Seychelles

Reg.No 000882

In this series, we will go through the operation, the functional basis, the technical implementation and present a clearer picture of the components of the Ixinium ecosystem and their coherence.

Introduction of the IXINIUM FOUNDATION

Foundation name: IXINIUM FOUNDATION

The Foundation is operative under The Seychelles Foundations Act

Founder: Baltic Representative Office 0Ü, Financial License FFA000389

Financial License Regulator: FIU, under the legislation of the European Union.

What makes the Ixinium Foundation so unique is the Foundation Charter, where is pointed out the rules and regulations of the Foundation.

As the Foundation is established to hold and protect the physical precious metals as assets against the Force Majeure for the Ixinium XXA, we made the Foundation Charter more bulletproof than any bank in the world can offer. Here’s how (direct copy from the Ixinium Foundation Charter):

- Upon the endowment of the Initial Foundation Assets to the Foundation, the Initial Foundation Assets shall become the sole property of the Foundation. They shall cease to be the property of the Founder.

- It is difficult to claim any assets back if you are not an owner of the assets.

- Upon any future endowment of assets to the Foundation (subsequent to the endowment of the Initial Foundation Assets), such assets shall become the sole property of the Foundation and shall cease to be the property of the Founder or any other person who endowed such assets to the Foundation.

- What goes into the Foundation stays into the Foundation.

- The Foundation Assets (including any part thereof) shall

not become the property of a Beneficiary unless actually distributed to that Beneficiary in accordance with this Charter or the Regulations.

-Every Foundation has a Beneficiary, who has either some access to the assets or get’s provisions from the interest of the assets etc. To eliminate this (what nobody else hasn’t ever done, at least what we know), we pointed out the Beneficiary and their rights as a Beneficiary.

Beneficiaries

- The Foundation is the sole legal and beneficial owner of the Foundation Assets.

- We made the Foundation to be the owner and the Beneficiary of the Foundation assets.

- A Beneficiary has no ownership interest of any nature in the Foundation or the Foundation’s assets and is not a creditor of the Foundation.

- By eliminating all the Beneficiary’s rights, we just made the bulletproof asset protection even more safe and sound.

- Foundation Assets (including any part thereof) shall not become the property of a Beneficiary unless actually distributed to such Beneficiary in accordance with this Charter or the Regulations.

- And added an extra protection layer to it, just in case.

- The purported assignment, transfer, charge, or other encumbrance of a Beneficiary’s existing or prospective interest under the Foundation is null and void.

- To make sure that what comes in stays in, we made sure that there are no laws in the world to make any claims against the Foundation assets.

- Any Beneficiary who attempts to assign, transfer, charge, or otherwise encumber their interest under the Foundation shall forfeit the same.

- If somebody even tries to “touch” the Foundation assets for some reason, that will be an epic fail.

Then what if the worst nightmare scenario is coming true, and for some odd reason, Ixinium has to shut down?

If there Is no surviving Founder (the company), divided equally among the Beneficiaries under the estate of the last surviving Founder.

-The only real beneficiaries are the Ixinium XXA owners as the Ixinium XXA is the company’s asset, which has been sold onto the market.

In this series, we will go through the operation, the functional basis, the technical implementation and present a clearer picture of the components of the Ixinium ecosystem and their coherence.

Introduction of the IXINIUM FOUNDATION

Foundation name: IXINIUM FOUNDATION

The Foundation is operative under The Seychelles Foundations Act

Founder: Baltic Representative Office 0Ü, Financial License FFA000389

Financial License Regulator: FIU, under the legislation of the European Union.

What makes the Ixinium Foundation so unique is the Foundation Charter, where is pointed out the rules and regulations of the Foundation. As the Foundation is established to hold and protect the physical precious metals as assets against the Force Majeure for the Ixinium XXA, we made the Foundation Charter more bulletproof than any bank in the world can offer. Here’s how (direct copy from the Ixinium Foundation Charter):

- Upon the endowment of the Initial Foundation Assets to the Foundation, the Initial Foundation Assets shall become the sole property of the Foundation. They shall cease to be the property of the Founder.

- Upon any future endowment of assets to the Foundation (subsequent to the endowment of the Initial Foundation Assets), such assets shall become the sole property of the Foundation and shall cease to be the property of the Founder or any other person who endowed such assets to the Foundation.

- The Foundation Assets (including any part thereof) shall not become the property of a Beneficiary unless actually distributed to that Beneficiary in accordance with this Charter or the Regulations.

Every Foundation has a Beneficiary, who has either some access to the assets or gets provisions from the interest of the assets etc. To eliminate this, we pointed out the Beneficiary and their rights as a Beneficiary.

Beneficiaries

- The Foundation is the sole legal and beneficial owner of the Foundation Assets.

- A Beneficiary has no ownership interest of any nature in the Foundation or the Foundation’s assets and is not a creditor of the Foundation.

- Foundation Assets (including any part thereof) shall not become the property of a Beneficiary unless actually distributed to such Beneficiary in accordance with this Charter or the Regulations.

- The purported assignment, transfer, charge, or other encumbrance of a Beneficiary’s existing or prospective interest under the Foundation is null and void.

- Any Beneficiary who attempts to assign, transfer, charge, or otherwise encumber their interest under the Foundation shall forfeit the same.

By eliminating all the Beneficiary’s rights, we just made the bulletproof asset protection even more safe and sound.

Then what if the worst nightmare scenario is coming true, and for some odd reason, Ixinium has to shut down, or XXA token has to remove completely from the market?

- If there Is no surviving Founder (the company), divided equally among the Beneficiaries under the estate of the last surviving Founder.

The only real beneficiaries are the Ixinium XXA owners as the Ixinium XXA is the company’s asset, which has been sold onto the market.

We just burned 6,748,217 XXA!

XXA burn transaction: https://stellar.expert/explorer/public/tx/8530f489225478296bb96cc023c11b7db0c0ea4a966d09e52f91787d2d57cf67

This is the first XXA burn, but not the last.

Cointelegraph market news:

The company has decided to make a massive Ixinium XXA burning. The purpose of the XXA burning is to lower down the maximum Ixinium XXA token supply and increase the physical precious metals packing per one Stellar network Ixinium XXA.

The total amount of the Ixinium XXA what the company will burn is 270,000,000 XXA. The total USD value of the burning process will be +$60,000,000 at the current Ixinium XXA USD rate 1 XXA = $0.2233. This burning process starts in Q4/2021 and lasts until the end of 2022. Ixinium XXA burning includes several transactions, where XXA’s will be transferred to the issuer account, Stellar address: GC4HS4CQCZULIOTGLLPGRAAMSBDLFRR6Y7HCUQG66LNQDISXKIXXADIM.

The current Ixinium XXA supply is 539,857,392 XXA. As the issuer account is locked, any more XXA can not be mint. The total supply after the Ixinium XXA burning process will be less than 270,000,000 XXA.

All the Ixinium XXA burns will have a public report with the blockchain transaction verification.

Stellar blockchain-based Ixinium XXA is now available on coinpanda.io. Coinpanda, the world’s most reliable and easy-to-use tax solution for cryptocurrencies. File your tax return in under 20 minutes. Learn how to reduce your taxes for next year.

Coinpanda has direct integration with more than 350 exchanges, wallets, and blockchains. Easily import all your historical transactions using API keys or CSV files. https://coinpanda.io/

Supported languages:

NEWS PROVIDED BY

Baltic Representative Office – Ixinium

Sep 08, 2021, 10:00 ET

On the 7th of September 2021, the Ixinium Foundation has purchased 125.0000 grams of Palladium. The latest Ixinium Foundation portfolio allocation report:

Customer No. 143026

compiled on 07/09/2021 at 14:40:19

PORTFOLIO

Securities account No: UK-2312178-R

Gold 76.1543 g

Palladium 31.3636 g

Platinum 77.4516 g

Silver 5,046.7478 g

Securities account No: UK-232877-E

Gold 268.0000 g

Palladium 125.000 g

Platinum 312.0000 g

Silver 12,150.0000 g

Ixinium Asset Token (IXAT)

On the 7th of September 2021, 11,269 IXAT tokens have been minted. IXAT is a Stellar blockchain-based

Ixinium Asset Token. When Ixinium Foundation purchases Precious Metals, the same USD amount of

IXAT tokens will be minted.

Precious Metals purchase (EUR) = 9,500.00

EUR-USD exchange rate= $1.1862

IXAT minted amount= 11,269 IXAT

IXAT total supply= 67,974 IXAT

Asset name: IXINIUM ASSET

Asset code: IXAT

Issuer address: GCSECMDTZDHAUCTZJO4Z3BGAGDKKV77TBGPBWPOAJUE6Z5N5JEU4CY4R

Current account: GCPKKAAJTXXRDFPRZ63HUTYXYVSFNMAITFNEZELSZEWFMFMRH6HSEWSH

Stellar network explorer: https://stellar.expert

Ixinium Foundation

A3, Bel Etang,

Hermitage Mont Fleuri,

Mahé Seychelles

Reg.No 000882

On the 6th of September 2021, the Ixinium Foundation has purchased 312.0000 grams of Platinum. The latest Ixinium Foundation portfolio allocation report:

Customer No. 143026

compiled on 06/09/2021 at 11:33:21

PORTFOLIO

Securities account No: UK-2312178-R

Gold 76.1543 g

Palladium 31.3636 g

Platinum 77.4516 g

Silver 5,046.7478 g

Securities account No: UK-232877-E

Gold 268.0000 g

Platinum 312.0000 g

Silver 12,150.0000 g

Ixinium Asset Token (IXAT)

On the 6th of September 2021, 11,269 IXAT tokens have been minted. IXAT is a Stellar blockchain-based

Ixinium Asset Token. When Ixinium Foundation purchases Precious Metals, the same USD amount of

IXAT tokens will be minted.

Precious Metals purchase (EUR) = 9,500.00

EUR-USD exchange rate= $1.1862

IXAT minted amount= 11,269 IXAT

IXAT total supply= 56,705 IXAT

Asset name: IXINIUM ASSET

Asset code: IXAT

Issuer address: GCSECMDTZDHAUCTZJO4Z3BGAGDKKV77TBGPBWPOAJUE6Z5N5JEU4CY4R

Current account: GCPKKAAJTXXRDFPRZ63HUTYXYVSFNMAITFNEZELSZEWFMFMRH6HSEWSH

Stellar network explorer: https://stellar.expert

Ixinium Foundation

A3, Bel Etang,

Hermitage Mont Fleuri,

Mahé Seychelles

Reg.No 000882

The Ixinium XXA cryptocurrency will henceforth have a physical precious-metal-based collateral value base. The Ixinium Foundation’s precious metals purchase program is ongoing and will increase the collateral base of the Ixinium XXA cryptocurrency regularly through additional purchases. We publish a purchase report for each precious metal purchase on the Ixinium website. The funds used by the Ixinium Foundation for the purchase of precious metals come from the issuance (sale) of the Ixinium XXA cryptocurrency and the volume-based commission structure income of cryptocurrency exchange services.

For the purchase of physical precious metals and their storage service, the Ixinium Foundation uses a German, very well-known and award-winning family business that has been operating in the industry for a long time. Purchased precious metals are stored by the international Brinks and Prosegur, some of the world’s largest precious metals storage companies. The Ixinium Foundation’s precious metal purchases focus on four different physical precious metals; gold, silver, platinum and palladium. The precious metals purchased by the Ixinium Foundation are manufactured by the internationally acclaimed Heraeus Group, which is more than 160 years old.

The precious metals managed by the Ixinium Foundation are 100% insured at full value with no cap at Lloyds of London on behalf of the precious metals storage companies Brinks and Prosegur.

The Ixinium Foundation uses only physical precious metals in its purchases. The Ixinium Foundation does not use or manage futures or ETF-based electronic precious metals trading contracts due to their high risk, as well as inadequate or non-existent insurance coverage.

Deserunt velit commodo exercitation officia qui nulla aliqua sunt. Ad do sunt Lorem esse qui voluptate exercitation Lorem cillum fugiat nisi dolore. Deserunt pariatur reprehenderit cupidatat id ad cillum exercitation exercitation sunt cupidatat velit. Amet aute labore fugiat irure non duis ex ea. Sit fugiat dolor excepteur quis exercitation adipisicing nulla occaecat sit irure veniam consectetur eu. Labore fugiat Lorem est fugiat ullamco. Ipsum eu sunt do dolore aliquip proident nisi nulla.

Laboris ea id labore ut eu deserunt est sint consequat Lorem consectetur velit. Ad sit ullamco labore qui do aliqua. Id do consectetur aliquip labore pariatur nulla. Fugiat cupidatat esse sunt et anim laborum laborum deserunt elit. Anim tempor fugiat labore laborum deserunt ipsum sint officia duis consectetur id consequat.

Ad cillum labore labore magna commodo voluptate ullamco adipisicing ipsum eiusmod exercitation anim magna excepteur. Labore incididunt ullamco nostrud exercitation aute ad non aliquip commodo ex eu ullamco esse ipsum. Qui do proident laboris id voluptate elit qui ea incididunt. Occaecat ea veniam exercitation proident sunt. Ipsum veniam quis occaecat adipisicing duis. Velit ea voluptate velit duis cillum. Mollit sint reprehenderit pariatur cupidatat.

Non amet non ad incididunt aliquip sunt. Laboris ullamco pariatur sunt consectetur sit commodo Lorem voluptate. Qui nostrud officia sit fugiat enim elit irure velit magna enim do duis proident aute.

Pariatur excepteur labore elit veniam. Est mollit non aliqua veniam. Qui esse magna quis irure nisi qui adipisicing commodo enim. Occaecat ut labore tempor tempor ut consectetur cupidatat. Et consectetur proident officia sunt elit.

Proident anim commodo occaecat eu veniam aute irure proident aute consectetur Lorem aute. Non et id irure dolore esse magna sint fugiat aliqua. Do tempor minim nisi Lorem occaecat ea Lorem do. Aliquip nulla sit ea proident exercitation nostrud esse voluptate velit est laboris. Quis reprehenderit exercitation pariatur reprehenderit et excepteur ea. Officia officia proident commodo commodo ullamco sit do aliqua culpa nostrud culpa.

Voluptate commodo labore adipisicing est mollit nulla laborum. Officia dolore veniam laborum deserunt consequat deserunt veniam aliquip. Aliqua aliquip occaecat aliquip eiusmod laborum laboris culpa qui. Dolor mollit cupidatat deserunt duis exercitation cupidatat commodo incididunt. Ea sit cupidatat ipsum deserunt nulla consequat occaecat ullamco do. Deserunt deserunt culpa ullamco Lorem sint excepteur ea irure.

Aute deserunt consequat aliquip pariatur consequat cillum ex velit ullamco. Sunt Lorem proident nostrud dolor commodo cillum tempor. Proident ex quis officia dolore Lorem qui cillum quis eiusmod. Consequat aute tempor dolore proident. Commodo enim et mollit sint. Enim ex eu laboris esse.

Reprehenderit sit et tempor qui laborum ullamco. Non occaecat id laboris dolore qui et incididunt. Nisi et dolore veniam labore magna anim pariatur eiusmod. Cillum anim ad laborum incididunt cillum dolore ullamco incididunt culpa irure proident aliquip mollit qui.

Eiusmod aliqua irure reprehenderit elit anim sint Lorem deserunt ut deserunt ut. Ut duis mollit in veniam ullamco. Culpa enim aliquip minim id sunt ut in. Cupidatat cillum aliquip culpa laborum aliquip ut duis proident.

Ixinium XXA #DeFi, in process. More information released in the near future.

On the 16th of October 2020, the Ixinium Foundation has purchased 86.0 g of Gold.

Ixinium Foundation DEPOT UK-232877-E portfolio allocation report:

GOLD BARS ALLOCATION 20.10.2020

Bar no.

Purity

Vault

Custodian

My Short Name

Portfolio

X90148-AU99

999.9 %

Zürich

Brinks

PSN-053321

86.0000 g

GOLD

Manufacturer/Supplier:

Heraeus Deutschland GmbH & Co. KG

Heraeusstr. 12-14

D-63450 Hanau

Germany

LBMA member

Ixinium Asset Token (IXAT)

On the 20th of October 2020, 5,736 IXAT tokens have been minted. IXAT is a Stellar blockchain-based Ixinium Asset Token. When Ixinium Foundation purchases Precious Metals, the same amount of IXAT tokens will be minted.

Precious Metals purchase (EUR) = 4,900.00

EUR-USD exchange rate=$1.17058

IXAT minted amount= 5,736 IXAT

IXAT total supply= 23,147 IXAT

Asset name: IXINIUM ASSET

Asset code: IXAT

Issuer address: GCSECMDTZDHAUCTZJO4Z3BGAGDKKV77TBGPBWPOAJUE6Z5N5JEU4CY4R

Current account: GCPKKAAJTXXRDFPRZ63HUTYXYVSFNMAITFNEZELSZEWFMFMRH6HSEWSH

Stellar network explorer: https://stellar.expert/

Since 2018, several EU member states have developed and implemented more or less comprehensive regulations and regulatory frameworks for crypto-assets and cryptofinance, with the most prominent examples being France, Germany, and Malta. Since around the same time, the call for an EU-wide crypto-asset regulation has grown louder. The European Commission (EC) is now poised to issue the EU framework for markets in crypto-assets before the end of the year.

So far, the EU did not provide its single financial services market a regulation addressing crypto-assets and cryptofinance. The situation is now changing.

For the crypto-asset regulatory framework, Ixinium welcomes all regulation changes and demands. We run already under the European Union financial market regulatory framework being a financial licensed company.

Read whole research here: https://www.seba.swiss/research/which-crypto-asset-regulation-for-european-union

Shopify – Canadian e-commerce giant, which offer to easy create own online shop will accept crypto payments because it has signed a contract with the company that offers crypto payment processor – CoinPayments

crypto wallet

Shopify is entering more and more into the world of crypto and blockchain. In February, the company joined the long-awaited association, created by Facebook founder Marek Zuckenberg – Libra. Earlier, Shopify also used Blockchain’s potency to get rid of illegal and counterfeit products from its supply chain.

Shopify-CoinPayments alliance will increase cryptocurrencies adoption

The Shopiy-ConPayments partnership was finally announced after a beta trial launched last year and which was a success. The alliance aims at a wider adoption of cryptographic payments.

Customers who want to pay by crypto will be able to do so at all merchants who will use the Shopify platform. Buyers will be able to use more than 1800 cryptocurrencies integrated with CoinPayments.

Merchants will receive payments faster and will also be able to accept foreign payments without banks ingeration.

Will cryptocurrencies payments become the new standard?

The CoinPayments platform is easy to integrate and use. Thanks to cooperation with Shopify, the company hopes to expand its presence on the global market. According to the project’s CEO, Jason Butcher, the company hopes to speed up cryptocurrencies adoption in the normal world.

Butcher said the beta tests, which began in 2019, included a thorough check of performance, interoperability and compatibility was checked with all Shopify customers. All security features have also been checked to ensure there will be no dangerous leaks.

Butcher claims that this alliance will be groundbreaking and unrivalled in the payments world.

Several other e-commerce companies and payment giants have also entered the global cryptographic world. Companies have already been set up to offer innovative crypto credit cards and crypto invoicing. The industry is currently undergoing revolutions, and the adoption of cryptocurrencies and blockchain technology is becoming increasingly common.

- Better content

- New video

- More partners and

- Much more to come!

The Stellar Development Foundation announced today that Samsung has added support for the Stellar cryptocurrency to its Samsung Blockchain Keystore, making it available to blockchain apps on recent Galaxy mobile devices. To make storage of Stellar lumens and other Stellar-based assets safer, SatoshiPay will utilize the Samsung Blockchain Keystore in its Solar wallet and its upcoming SatoshiPay B2B mobile app.

Read the whole story:

https://medium.com/@SatoshiPay/samsung-adds-stellar-support-to-millions-of-galaxy-devices-7b4e1b0b5068

Event Duration: 27 Jul 2020 (Monday), 15:00 KST – 9 Aug 2020 (Sunday) 23:00 KST

Prize Pool: 200,000 XXA

Special Prizes for all Participants!

- Special Prize is divided equally among all the eligible participants.

- Eligible Special Prize Winners must have a minimum XXA trading volume of 150,000 USDT within the event duration.

- *Special Prize Pool is computed as 5% of the average of the top 3 trading volumes on the leaderboard, capped at a maximum of 100,000 XXA worth.

Goldman Sachs Group Inc. put a spotlight on the suddenly growing concern over inflation in the U.S. by issuing a bold warning Tuesday that the dollar is in danger of losing its status as the world’s reserve currency.

More than 2,000 vending machines in Australia and New Zealand will let customers buy a Coke with bitcoin.

Coca-Cola Amatil, the Asia-Pacific bottling giant, has partnered with digital assets platform Centrapay to integrate bitcoin as a payment option from its vending machines across Australia and New Zealand.

This means over 2,000 smart vending machines now accept cryptocurrency.

The machines running the bitcoin transactions are owned by Coca-Cola Amatil, a regional bottler and distributor of Coca-Cola products. While the Atlanta-based soft drink producer is a major shareholder in the distributor, the two are separate companies.

Transactions are conducted via New Zealand-based Centrapay and Sylo Smart Wallet, which currently has about 250,000 users. Newcomers can download the Sylo app on their smartphones, add bitcoin to their wallets and scan a QR code to purchase Amatil products.

Sylo co-founder and business manager Dorian Johannink said the digital wallet can typically store, send and receive cryptocurrencies including bitcoin and ERC20-compatible tokens like its own SYLO listed on Hong Kong exchange KuCoin.

“But for the Coke scenario, it’s just supported for bitcoin initially for the trial run, but we may extend the functionality,” Johannink said.

Buying a Coke with bitcoin sounds catchy, but the cryptocurrency has notoriously limited scalability, processing an average of 1 megabyte worth of transactions every 10 minutes, after which bitcoin miners prioritize transactions with higher fees.

But Sylo’s main focus is not on bitcoin as a payment form, but on the vision of connecting crypto to the real world and using the architecture of this trial to roll out digital assets as payment tools more broadly. Centrapay announced the partnership on Twitter Monday, echoing Sylo in claiming it was the “first step toward mainstream digital transactions.” The future, as Sylo envisions it, will allow customers to purchase a digital asset in the real world, perhaps a Coke token, and use it to purchase products.

Sylo has moved quickly in the last few months, going from adding bitcoin to its wallet back in March and listing its token on KuCoin, to a real-world trial run in crypto transactions. According to Centrapay CEO Jerome Faury, the initiative has already demonstrated it can work in Australia and New Zealand, and will be “targeting the U.S. market next with some world-first innovations.”

Johannink said Faury has already established connections in the United States and there are plans to move things quickly, but the regional partnership is still in its nascent stages.

Sylo is determined.

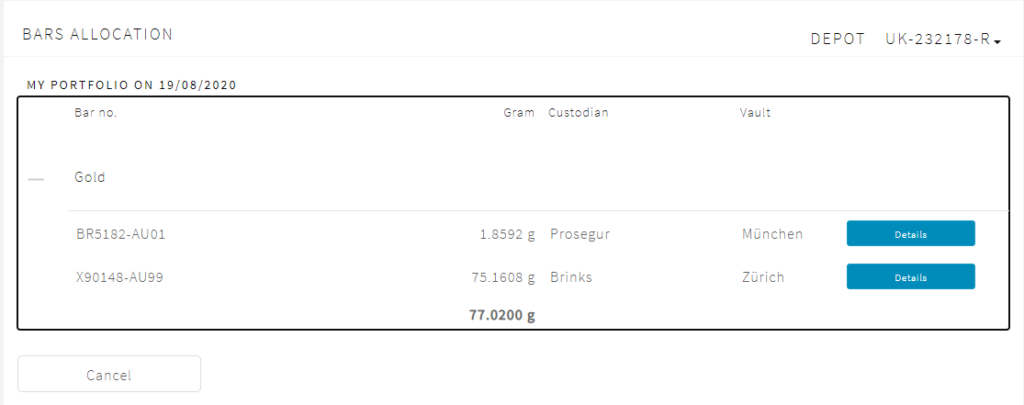

On 17th of August 2020, the Ixinium Foundation has purchased 77.0200 g of Gold.

Ixinium Foundation DEPOT UK-232178-R portfolio allocation report:

GOLD BARS ALLOCATION 19.08.2020

Bar no.

Purity

Vault

Custodian

My Short Name

Portfolio

Bar no.

Purity

Vault

Custodian

My Short name

Portfolio

BR5182-AU01

999.9 %

München

Prosegur

PSN-053321

1.8592 g

X90148-AU99

999.9 %

Zürich

Brinks

PSN-053321

75.1608 g

GOLD

Manufacturer/Supplier:

Heraeus Deutschland GmbH & Co. KG

Heraeusstr. 12-14

D-63450 Hanau

Germany

LBMA member

Ixinium Asset Token (IXAT)

On 18-20th of August 2020, 5,822 IXAT tokens has been minted. IXAT is Stellar blockchain based Ixinium Asset Token. When Ixinium Foundation purchases Precious Metals, the same amount of IXAT tokens will be minted.

Precious Metals purchase (EUR) = 4,905.00

EUR-USD exchange rate=$1.187

IXAT minted amount= 5,822 IXAT

IXAT total supply= 5,822 IXAT

Asset name: IXINIUM ASSET

Asset code: IXAT

Issuer address: GCSECMDTZDHAUCTZJO4Z3BGAGDKKV77TBGPBWPOAJUE6Z5N5JEU4CY4R

Current account: GCPKKAAJTXXRDFPRZ63HUTYXYVSFNMAITFNEZELSZEWFMFMRH6HSEWSH

Stellar network explorer: https://stellar.expert/

On 21th of August 2020, the Ixinium Foundation has purchased 5,104.1667 g of Silver.

Ixinium Foundation DEPOT UK-232178-R portfolio allocation report:

SILVER BARS ALLOCATION 21.08.2020

Bar no.

Purity

Vault

Custodian

My Short Name

Portfolio

Bar no.

Purity

Vault

Custodian

My Short name

Portfolio

Bar no.

Purity

Vault

Custodian

My Short name

Portfolio

V03227-AG98

999.9 %

Zürich

Brinks

PSN-053321

562.4473 g

V03279-AG98

999.9 %

Zürich

Brinks

PSN-053321

2,270.8597 g

V03316-AG98

999.9 %

Zürich

Brinks

PSN-053321

2,270.8597 g

SILVER

Manufacturer/Supplier:

Argor-Heraeus SA, part of the Heraeus Group

Via Moree 14

CH-6850 Mendrisio

Switzerland

LBMA member

Ixinium Asset Token (IXAT)

On 22th of August 2020, 5,792 IXAT tokens has been minted. IXAT is Stellar blockchain based Ixinium Asset Token. When Ixinium Foundation purchases Precious Metals, the same amount of IXAT tokens will be minted.

Precious Metals purchase (EUR) = 4,900.00

EUR-USD exchange rate=$1.182

IXAT minted amount= 5,792 IXAT

IXAT total supply= 11,614 IXAT

Asset name: IXINIUM ASSET

Asset code: IXAT

Issuer address: GCSECMDTZDHAUCTZJO4Z3BGAGDKKV77TBGPBWPOAJUE6Z5N5JEU4CY4R

Current account: GCPKKAAJTXXRDFPRZ63HUTYXYVSFNMAITFNEZELSZEWFMFMRH6HSEWSH

Stellar network explorer: https://stellar.expert/

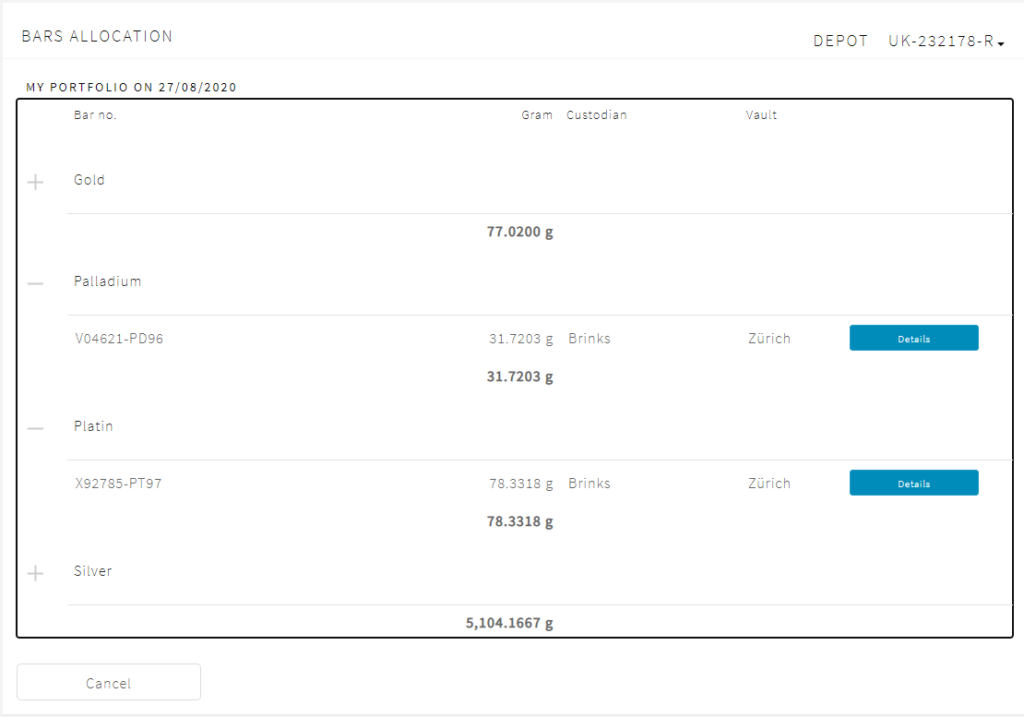

On 26th of August 2020, the Ixinium Foundation has purchased 31.7203 g of Palladium and 78.3318 g of Platinum.

Ixinium Foundation DEPOT UK-232178-R portfolio allocation report:

PALLADIUM BARS ALLOCATION 27.08.2020

Bar no.

Purity

Vault

Custodian

My Short Name

Portfolio

V04621-PD96

999.9 %

Zürich

Brinks

PSN-053321

31.7203 g

PALLADIUM

Manufacturer/Supplier:

Heraeus Deutschland GmbH & Co. KG

Heraeusstr. 12-14

D-63450 Hanau

Germany

LBMA member

PLATINUM BARS ALLOCATION 27.08.2020

Bar no.

Purity

Vault

Custodian

My Short Name

Portfolio

X92785-PT97

999.9 %

Zürich

Brinks

PSN-053321

78.3318 g

PLATINUM

Manufacturer/Supplier:

Heraeus Deutschland GmbH & Co. KG

Heraeusstr. 12-14

D-63450 Hanau

Germany

LBMA member

Ixinium Asset Token (IXAT)

On 27th of August 2020, 5,797 IXAT tokens has been minted. IXAT is Stellar blockchain based Ixinium Asset Token. When Ixinium Foundation purchases Precious Metals, the same amount of IXAT tokens will be minted.

Precious Metals purchase (EUR):

PALLADIUM=2,450.00

PLATINUM=2,450.00

TOTAL=4,900.00

EUR-USD exchange rate=$1.183

IXAT minted amount= 5,797 IXAT

IXAT total supply= 17,411 IXAT

Asset name: IXINIUM ASSET

Asset code: IXAT

Issuer address: GCSECMDTZDHAUCTZJO4Z3BGAGDKKV77TBGPBWPOAJUE6Z5N5JEU4CY4R

Current account: GCPKKAAJTXXRDFPRZ63HUTYXYVSFNMAITFNEZELSZEWFMFMRH6HSEWSH

Stellar network explorer: https://stellar.expert/

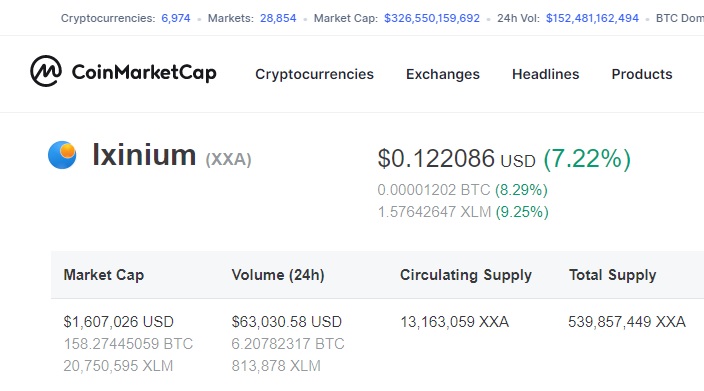

Today 9th of September 2020, CoinMarketCap has updated XXA’s market cap.

https://coinmarketcap.com/currencies/ixinium/markets/

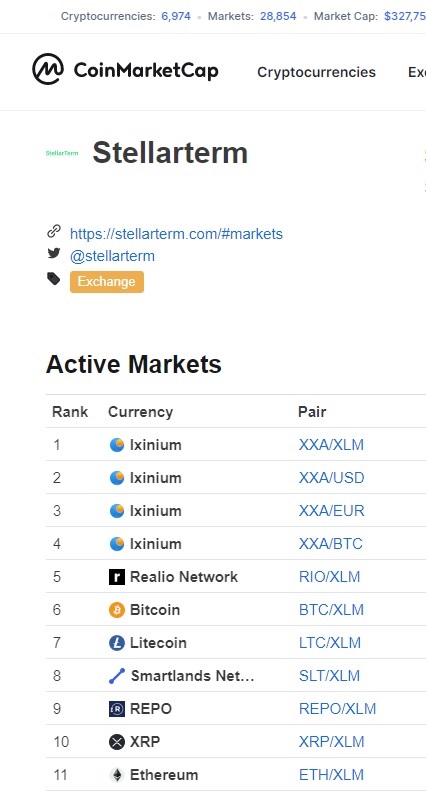

We have made a good market entry footprint as passing two Stellar network pioneers, Smartlands [SLT] and Stronghold [SHX] in market cap and in volume(24h). At the same time Ixinium XXA market pairs rise to the overall lead on Stellarterm exchange https://coinmarketcap.com/exchanges/stellar-decentralized-exchange/.

Stellar is made for payments and asset issuance. It was created for developers and connects financial systems so they can work together on a single platform.

Stellar is an open, decentralized, fast, scalable, and uniquely sustainable network for financial products and services. The total number of accounts is approximately 4.5 million and over the course of Q2, the number of total payments from those accounts grew almost 40%. The average daily volume on Stellar’s Decentralized Exchange saw sizable growth, an increase of over 70% from last quarter.

Read the whole interview:

https://www.financemagnates.com/cryptocurrency/news/financial-inclusion-the-future-stellar-development-foundation-head-speaks/