Ripple’s XRP & Stellar Lumens is the only crypto that is part of ISO 20022 and can work with CBDC’s – Report

Good news for Ixinium XXA!

You can read our updated white paper here:

We get a lot of the same questions from investors and asset holders about the current situation, therefore we decided to answer those collectively.

Only a few years ago, the crypto market was going it’s own way, not correlating with the stock market. The crypto market was considered even a safe haven, when other assets such as traditional stocks were facing bearish times. Now, on the other hand, there seems to be a strong correlation between the crypto and stock markets.

The year 2022 so far has been a slow downhill, with a few exceptions of course. The Dow Jones index, for example, opened this year at 36,300 and is currently at around 31,300. Stellar Lumens was at the beginning of January 2022 at $0,30 and now it is trying to stay above $0,10. The market situation accompanied with the worlds geopolitical challenges that create a tsunami of uncertainty, have put many investors into a situation, where everybody is just waiting for somebody to do something.

Ixinium XXA’s year 2022 has been a bumpy ride. XXA was at $0,18 in the begining of January, but it fell below $0,06 in March. But then, in mid April our token was at $0,33 at its peak this year. What was the reason behind that bullride?

The price of our token is decided by the market – that is the buyers and the sellers of XXA. Like any other asset out there, a few key principles apply to XXA also. Supply and demand, the liquidity behind the asset and holding versus trading the token.

Whenever there are more buyers than sellers, the value of the token tends to go up and vice versa. When the demand exceeds the supply of the circulating tokens, the issuer can release more tokens into circulation. That creates revenue to the company, which is allocated as stated in our whitepaper:

35% goes to support the liquidity of XXA into the liquidity pool, 35% to physical precious metal purchases, max. 15% goes to marketing and the remaining to administrative expenses and salaries.

Ixinium XXA was created to be a unique digital asset, backed by physical precious metals, which is a safe haven for investors. But why aren’t there more people investing their wealth in it? We get two questions quite often that may provide an answer for the hesitance. Why is there not more physical precious metals backing the token, being the first question, and why is the value of the token not rising steadily, being the second one?

In order for the company to buy more precious metals, there needs to be revenue coming into the company. Like stated above, there needs to be more buyers than sellers, more demand than the current supply in the market to create that enviroment. The more people invest into our token, the more liquidity goes behind the token. That creates enventually a more stable situation, resulting in smaller price swings.

The traders don’t care if the value goes up or down. They take profit from price swings. The holders, ie. regular investors, seek long term profits.

Ixinium XXA has a bright future ahead. Now is the time for action. One good way to support the stability of the token, is to take part in the liquidity pool. When the liquidity behind the token is sufficient, Ixinium can allocate more incoming revenue towards physical precious metal purchases.

As conclusion, Ixinium XXA is a truly transparent business, that goes where the market drives it to. Which direction will you steer this ship?

On June the 16th 2022, three years have passed since the listing of Ixinium.io (XXA). In three years, Ixinium has achieved a stable position in the market and has become one of the most traded crypto assets in the Stellar blockchain.

The wave of uncertainty that has shaken the world has also stirred the cryptocurrency market and people are looking for safer places to investment their wealth in. However, investing solely in security doesn’t attract many, but naturally a return is also sought for the investment. Ixinium’s precious metal base with force majeure protection creates a basis for security, and with the precious metals purchase program, the value of our currency will increase even more. When we add a growing exchange rate according to supply and demand, we can talk about Ixinium being a safe haven currency!

We now want to offer something in return in honor of our birthday!

When you buy at least 300 XXA’s from the market, we will send you a bonus of 30 XXA’s on top of the trade. After purchasing, email us your Stellar address so we can confirm your purchase from the blockchain. Once we have verified the amount of your purchase, we will send the bonus XXA’s to the Stellar address you provided.

The campaign is valid from the 26th of May to the 30th of June 2022.

The official email address for Ixinium is office@ixinium.io. Please type ‘Bonus XXA’ as subject to the email. You can also add the link to the transaction from stellar.expert, if you want to speed up our processing time of the bonus payment.

How To Buy and Swap Ixinium (XXA) — Watch Step by Step Videos!

01. – How to set up a LOBSTR app

02. – How to buy XLM

03. – How to swap XLM to XXA

04. – How to trade XXA

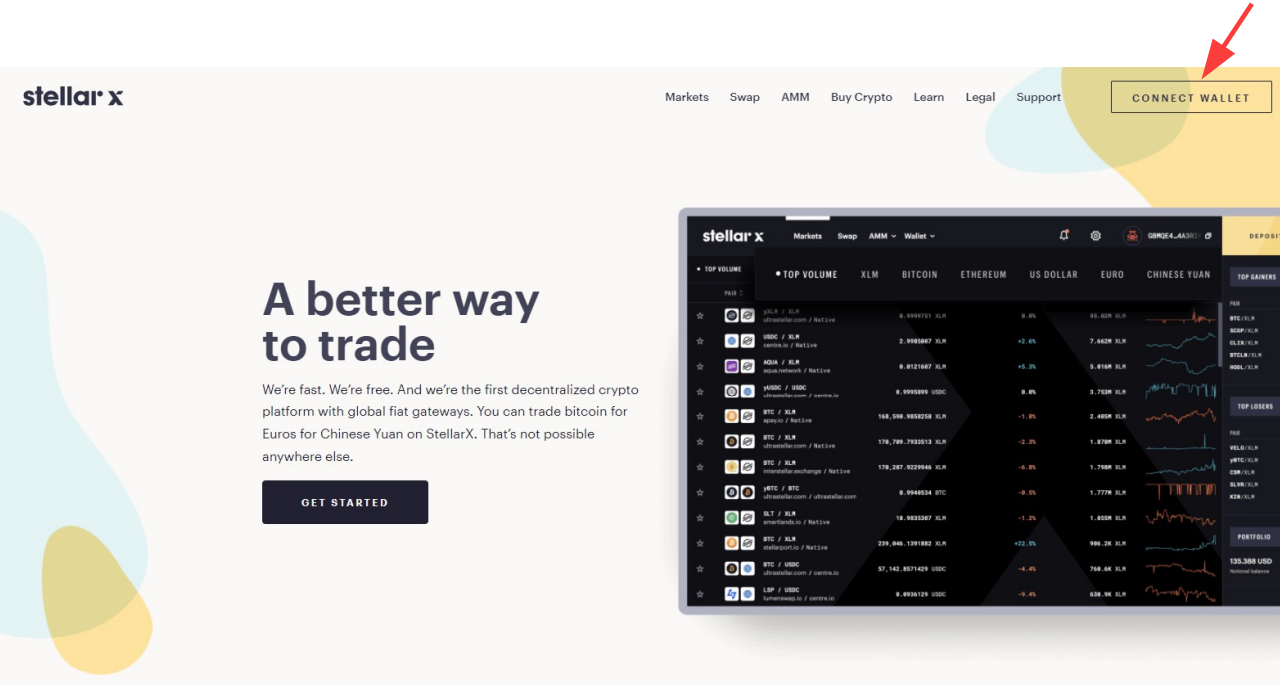

1. Go to the StellarX page https://www.stellarx.com and select CONNECT WALLET

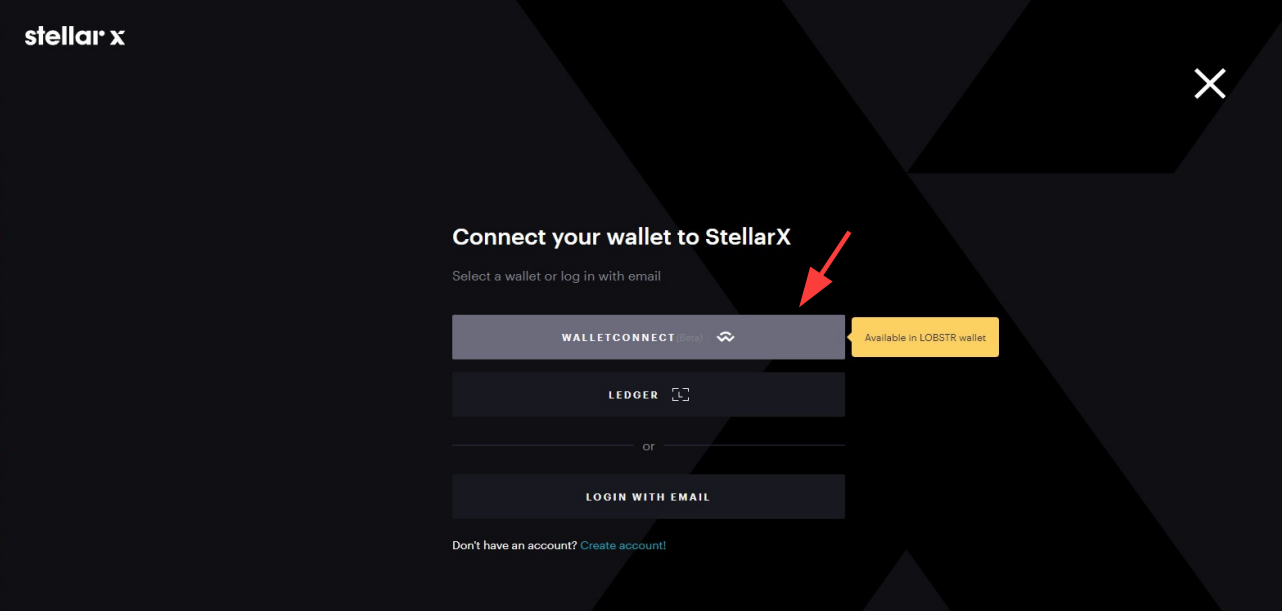

2. Select WalletConnect login option

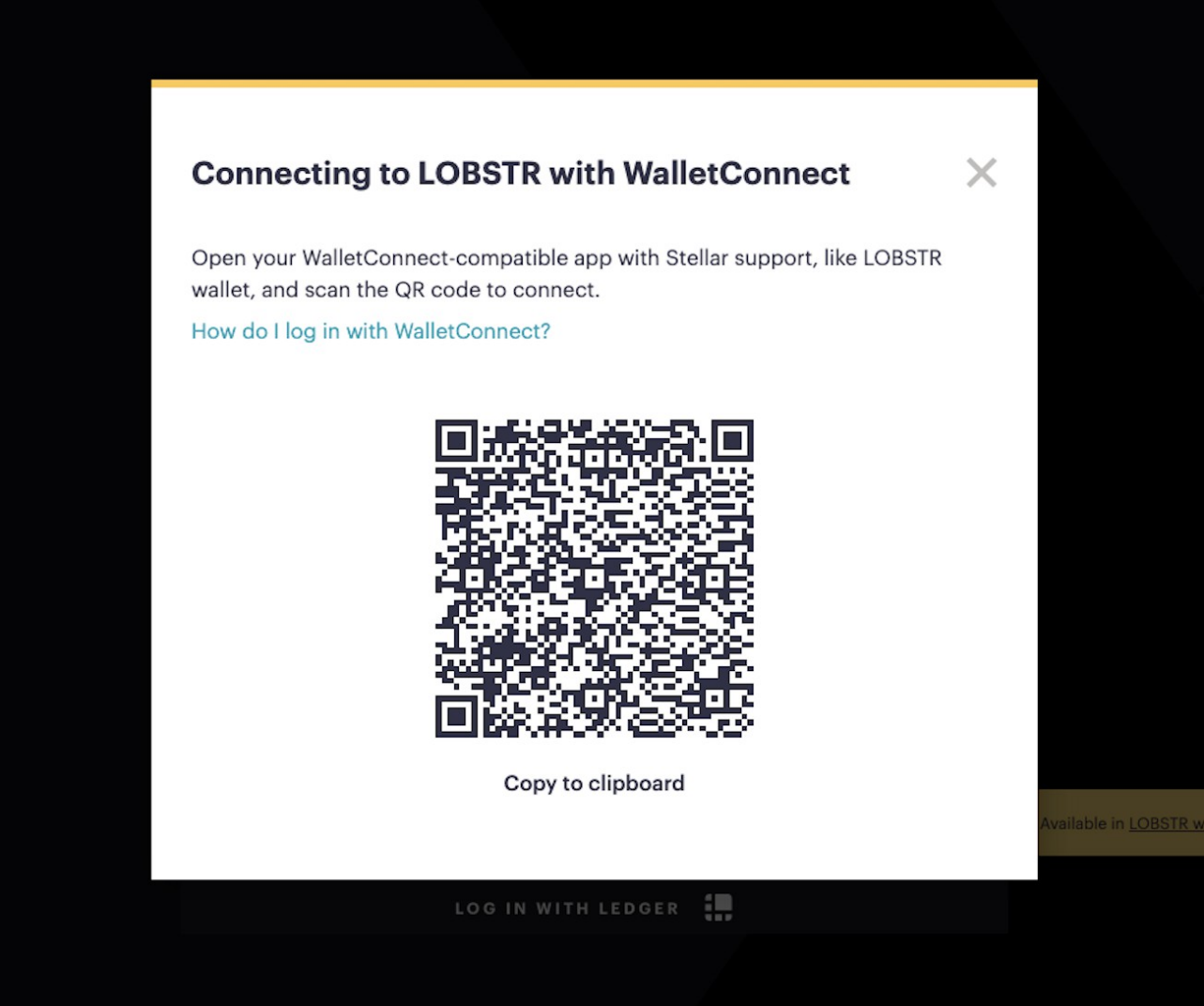

3. The Scan QR code pop-up will now appear. Next, you need to scan the displayed QR code from your LOBSTR application to connect StellarX with your wallet on LOBSTR.

4. Open the LOBSTR app on your mobile device.

If you do not yet use LOBSTR you can get the app from either the Apple or Google Play stores:

● Download on the App Store (link: https://apps.apple.com/us/app/lobstr-stellar-wallet/id1404357892)

● Grab it on Google Play (Link: https://play.google.com/store/apps/details?id=com.lobstr.client?

Once you have the LOBSTR app, you will need to either sign up or log in to your LOBSTR account. If you’re a new user to LOBSTR you can create a new Stellar Wallet or connecting one you already use to your account.

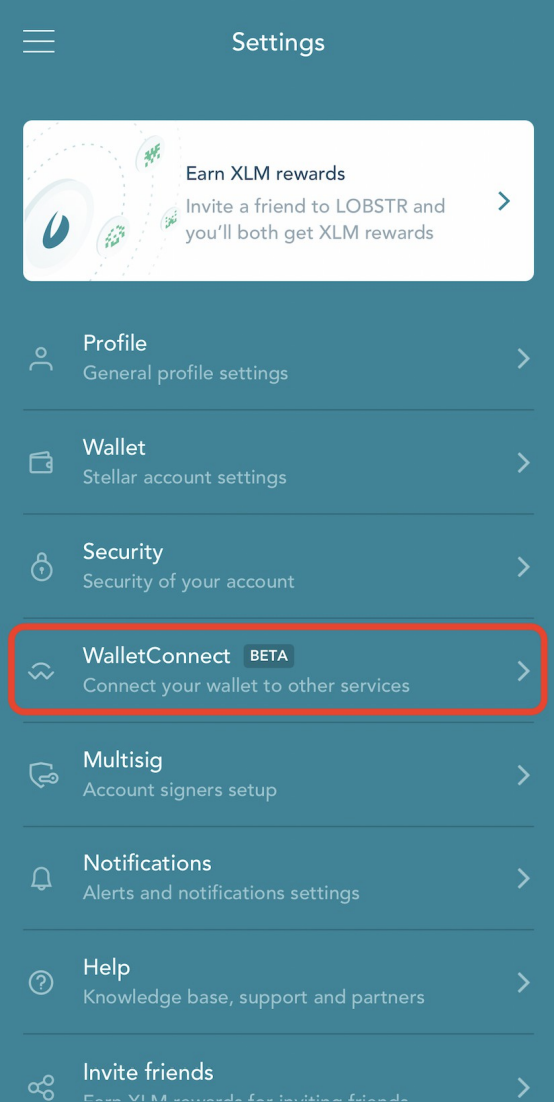

5. Navigate to the menu ≡ icon in the top left corner, click Settings, then choose WalletConnect from the menu.

6. Click the + button in the top right or the New Connection button to open up the camera and scan the QR code given to you by StellarX.

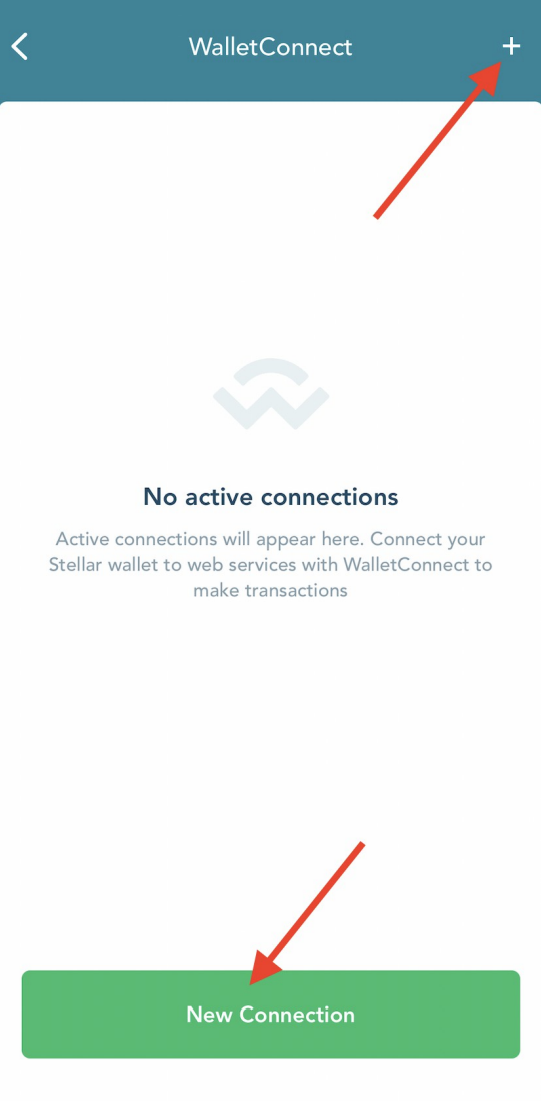

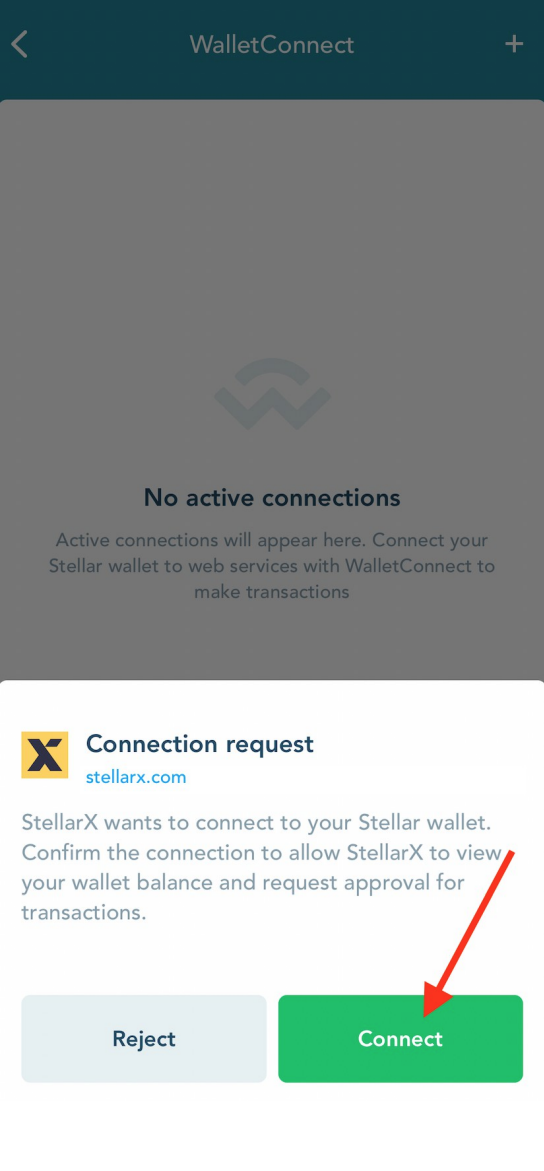

7. Confirm the connection in LOBSTR app

You will now see a Cancel/Confirm notification on the LOBSTR app. If you press Cancel the session will be canceled. If you press Confirm then StellarX will log in with your Stellar Wallet from LOBSTR.

You are now logged with your Stellar Wallet from the LOBSTR app. From here you can now use StellarX the same way as any other log in option. Every time you make an action in your wallet, like making a payment or creating an offer, you will now be asked to confirm the transaction in the LOBSTR app.

By confirming the transaction in LOBSTR app, you sign this transaction using the secret key of your Stellar Wallet from the LOBSTR app. This means your private key stays safely in your LOBSTR app, without the need for it to be put directly into StellarX.

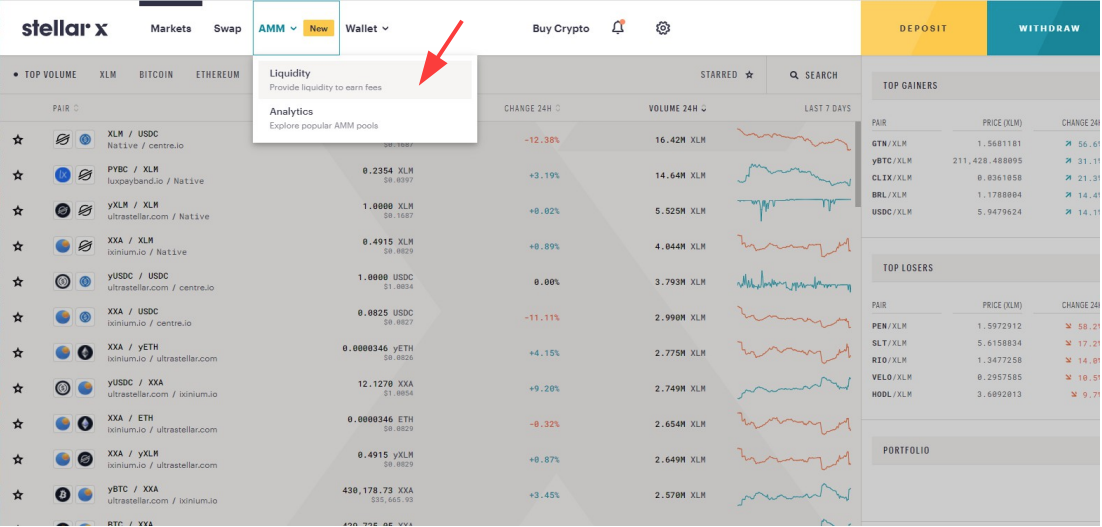

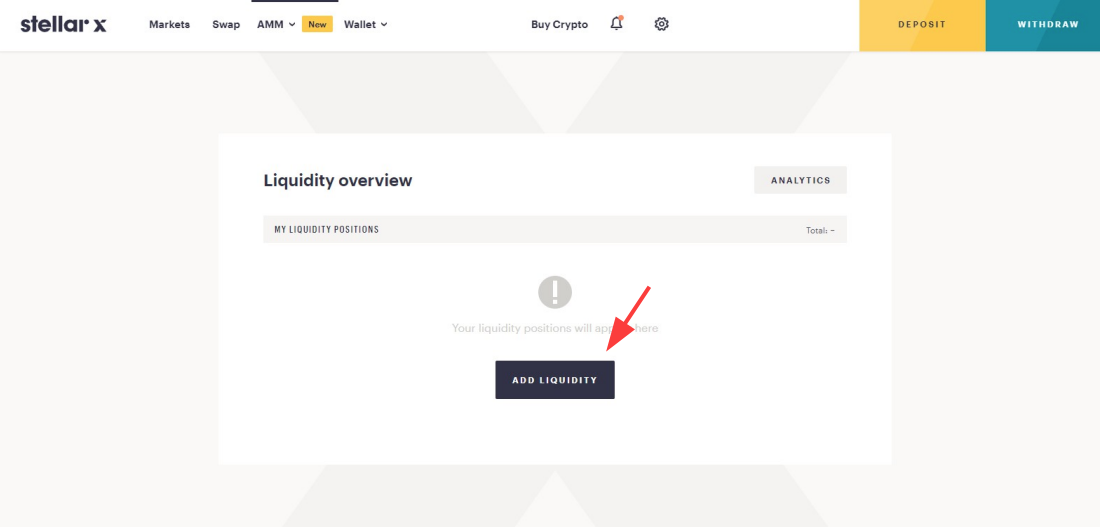

8. Add XXAs to the Stellar liquidity pool. Go to the AMM->Liquidity

9. Go to the ADD LIQUIDITY

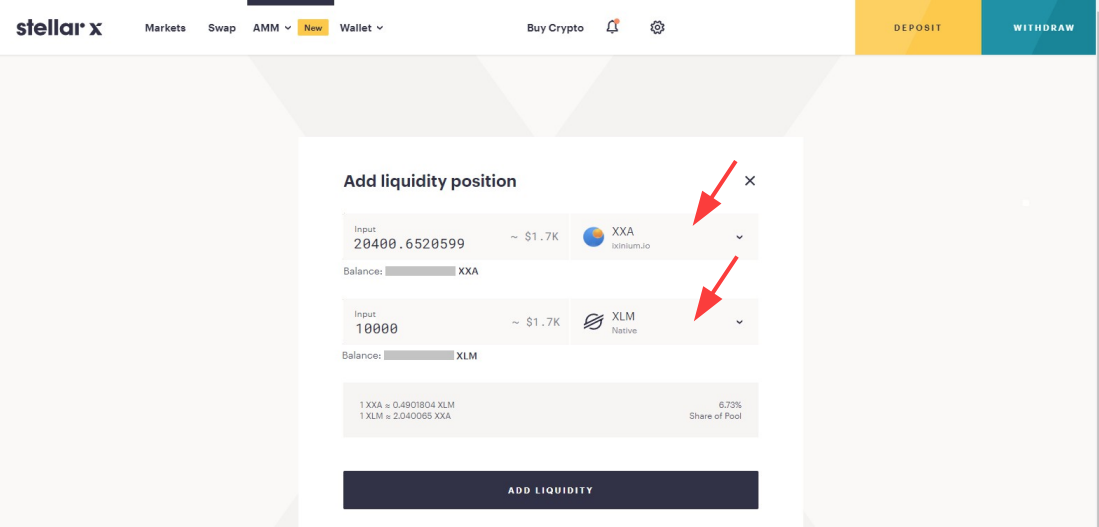

10. Select XXA to the first token and XLM to the second token. Choose the amount of the XXA you want to put into the XXA/XLM liquidity pool and the needed XLM amount will come automatically.

Or

You can choose the amount of the XLM you want to put into the XXA/XLM liquidity pool and the needed XXA amount will come automatically.

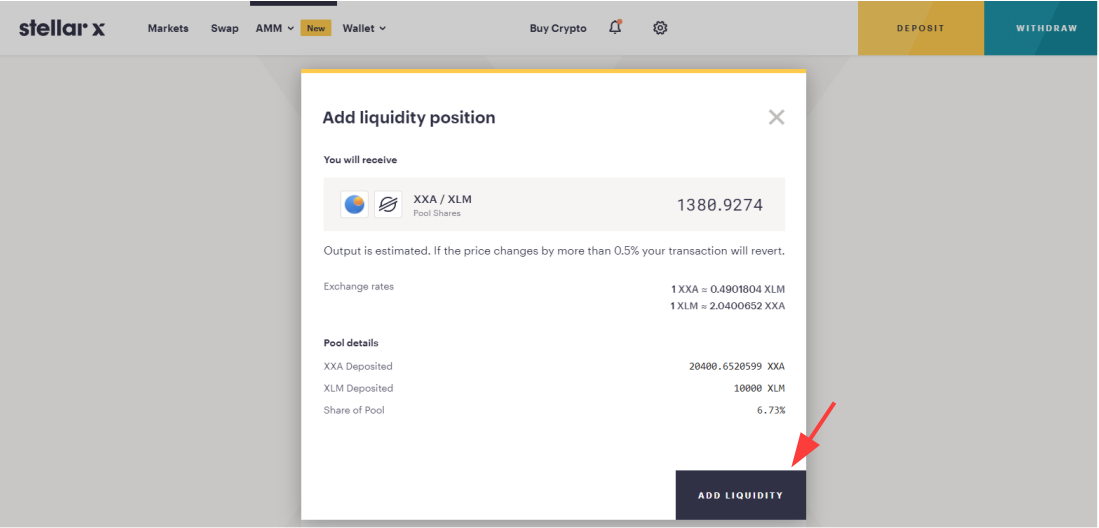

11. Go to the ADD LIQUIDITY

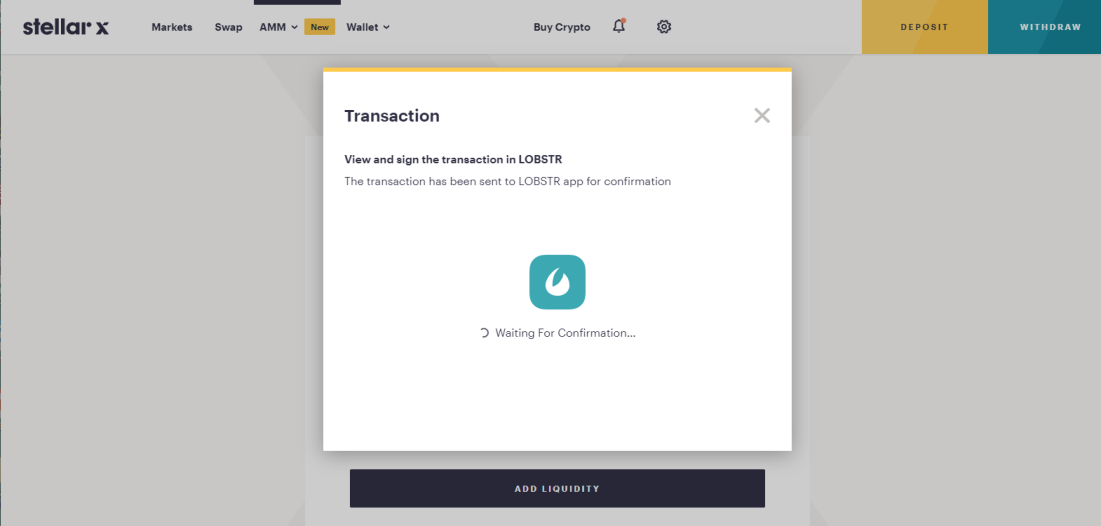

12. Confirm and sign the transaction on your LOBSTR app.

After the successful confirmation, you have successfully participated XXA liquidity pool.

There are many different XXA pools with different interest ratios and more liquidity pools coming. We hope you enjoy this new and interesting way of using Ixinium XXA.

Official exchange partner of the Ixinium XXA. Stellar DEX trading with the first-class Token Swap.

The Ixinium team has applied CertiK auditing for the Ethereum XXA code couple of weeks ago.

Auditing with vulnerability report and preliminary comments are now made. There are a couple of things to be modified/updated, so The Code is back in the coder’s workshop to be developed in the way described on the CertiK audit report.

After the modification, The Code will be sent back to the CertiK for a new audit.

Ixinium XXA liquidity pool/-s for the Ethereum network is scheduled to launch on the UniSwap V3 only after the CertiK audit report shows that The Code is OK.

In this series, we will go through the operation, the functional basis, the technical implementation and present a clearer picture of the components of the Ixinium ecosystem and their coherence.

Introduction of the IXINIUM FOUNDATION

Foundation name: IXINIUM FOUNDATION

The Foundation is operative under The Seychelles Foundations Act

Founder: Baltic Representative Office 0Ü, Financial License FFA000389

Financial License Regulator: FIU, under the legislation of the European Union.

What makes the Ixinium Foundation so unique is the Foundation Charter, where is pointed out the rules and regulations of the Foundation.

As the Foundation is established to hold and protect the physical precious metals as assets against the Force Majeure for the Ixinium XXA, we made the Foundation Charter more bulletproof than any bank in the world can offer. Here’s how (direct copy from the Ixinium Foundation Charter):

- Upon the endowment of the Initial Foundation Assets to the Foundation, the Initial Foundation Assets shall become the sole property of the Foundation. They shall cease to be the property of the Founder.

- It is difficult to claim any assets back if you are not an owner of the assets.

- Upon any future endowment of assets to the Foundation (subsequent to the endowment of the Initial Foundation Assets), such assets shall become the sole property of the Foundation and shall cease to be the property of the Founder or any other person who endowed such assets to the Foundation.

- What goes into the Foundation stays into the Foundation.

- The Foundation Assets (including any part thereof) shall

not become the property of a Beneficiary unless actually distributed to that Beneficiary in accordance with this Charter or the Regulations.

-Every Foundation has a Beneficiary, who has either some access to the assets or get’s provisions from the interest of the assets etc. To eliminate this (what nobody else hasn’t ever done, at least what we know), we pointed out the Beneficiary and their rights as a Beneficiary.

Beneficiaries

- The Foundation is the sole legal and beneficial owner of the Foundation Assets.

- We made the Foundation to be the owner and the Beneficiary of the Foundation assets.

- A Beneficiary has no ownership interest of any nature in the Foundation or the Foundation’s assets and is not a creditor of the Foundation.

- By eliminating all the Beneficiary’s rights, we just made the bulletproof asset protection even more safe and sound.

- Foundation Assets (including any part thereof) shall not become the property of a Beneficiary unless actually distributed to such Beneficiary in accordance with this Charter or the Regulations.

- And added an extra protection layer to it, just in case.

- The purported assignment, transfer, charge, or other encumbrance of a Beneficiary’s existing or prospective interest under the Foundation is null and void.

- To make sure that what comes in stays in, we made sure that there are no laws in the world to make any claims against the Foundation assets.

- Any Beneficiary who attempts to assign, transfer, charge, or otherwise encumber their interest under the Foundation shall forfeit the same.

- If somebody even tries to “touch” the Foundation assets for some reason, that will be an epic fail.

Then what if the worst nightmare scenario is coming true, and for some odd reason, Ixinium has to shut down?

If there Is no surviving Founder (the company), divided equally among the Beneficiaries under the estate of the last surviving Founder.

-The only real beneficiaries are the Ixinium XXA owners as the Ixinium XXA is the company’s asset, which has been sold onto the market.

In this series, we will go through the operation, the functional basis, the technical implementation and present a clearer picture of the components of the Ixinium ecosystem and their coherence.

Introduction of the IXINIUM FOUNDATION

Foundation name: IXINIUM FOUNDATION

The Foundation is operative under The Seychelles Foundations Act

Founder: Baltic Representative Office 0Ü, Financial License FFA000389

Financial License Regulator: FIU, under the legislation of the European Union.

What makes the Ixinium Foundation so unique is the Foundation Charter, where is pointed out the rules and regulations of the Foundation. As the Foundation is established to hold and protect the physical precious metals as assets against the Force Majeure for the Ixinium XXA, we made the Foundation Charter more bulletproof than any bank in the world can offer. Here’s how (direct copy from the Ixinium Foundation Charter):

- Upon the endowment of the Initial Foundation Assets to the Foundation, the Initial Foundation Assets shall become the sole property of the Foundation. They shall cease to be the property of the Founder.

- Upon any future endowment of assets to the Foundation (subsequent to the endowment of the Initial Foundation Assets), such assets shall become the sole property of the Foundation and shall cease to be the property of the Founder or any other person who endowed such assets to the Foundation.

- The Foundation Assets (including any part thereof) shall not become the property of a Beneficiary unless actually distributed to that Beneficiary in accordance with this Charter or the Regulations.

Every Foundation has a Beneficiary, who has either some access to the assets or gets provisions from the interest of the assets etc. To eliminate this, we pointed out the Beneficiary and their rights as a Beneficiary.

Beneficiaries

- The Foundation is the sole legal and beneficial owner of the Foundation Assets.

- A Beneficiary has no ownership interest of any nature in the Foundation or the Foundation’s assets and is not a creditor of the Foundation.

- Foundation Assets (including any part thereof) shall not become the property of a Beneficiary unless actually distributed to such Beneficiary in accordance with this Charter or the Regulations.

- The purported assignment, transfer, charge, or other encumbrance of a Beneficiary’s existing or prospective interest under the Foundation is null and void.

- Any Beneficiary who attempts to assign, transfer, charge, or otherwise encumber their interest under the Foundation shall forfeit the same.

By eliminating all the Beneficiary’s rights, we just made the bulletproof asset protection even more safe and sound.

Then what if the worst nightmare scenario is coming true, and for some odd reason, Ixinium has to shut down, or XXA token has to remove completely from the market?

- If there Is no surviving Founder (the company), divided equally among the Beneficiaries under the estate of the last surviving Founder.

The only real beneficiaries are the Ixinium XXA owners as the Ixinium XXA is the company’s asset, which has been sold onto the market.

NEWS PROVIDED BY

Baltic Representative Office – Ixinium

Sep 08, 2021, 10:00 ET

Stellar blockchain-based Ixinium XXA is now available on coinpanda.io. Coinpanda, the world’s most reliable and easy-to-use tax solution for cryptocurrencies. File your tax return in under 20 minutes. Learn how to reduce your taxes for next year.

Coinpanda has direct integration with more than 350 exchanges, wallets, and blockchains. Easily import all your historical transactions using API keys or CSV files. https://coinpanda.io/

Supported languages:

The company has decided to make a massive Ixinium XXA burning. The purpose of the XXA burning is to lower down the maximum Ixinium XXA token supply and increase the physical precious metals packing per one Stellar network Ixinium XXA.

The total amount of the Ixinium XXA what the company will burn is 270,000,000 XXA. The total USD value of the burning process will be +$60,000,000 at the current Ixinium XXA USD rate 1 XXA = $0.2233. This burning process starts in Q4/2021 and lasts until the end of 2022. Ixinium XXA burning includes several transactions, where XXA’s will be transferred to the issuer account, Stellar address: GC4HS4CQCZULIOTGLLPGRAAMSBDLFRR6Y7HCUQG66LNQDISXKIXXADIM.

The current Ixinium XXA supply is 539,857,392 XXA. As the issuer account is locked, any more XXA can not be mint. The total supply after the Ixinium XXA burning process will be less than 270,000,000 XXA.

All the Ixinium XXA burns will have a public report with the blockchain transaction verification.

Cointelegraph market news:

We just burned 6,748,217 XXA!

XXA burn transaction: https://stellar.expert/explorer/public/tx/8530f489225478296bb96cc023c11b7db0c0ea4a966d09e52f91787d2d57cf67

This is the first XXA burn, but not the last.

Stellar blockchain-based Ixinium XXA is now available on coinpanda.io. Coinpanda, the world’s most reliable and easy-to-use tax solution for cryptocurrencies. File your tax return in under 20 minutes. Learn how to reduce your taxes for next year.

Coinpanda has direct integration with more than 350 exchanges, wallets, and blockchains. Easily import all your historical transactions using API keys or CSV files. https://coinpanda.io/

Supported languages:

NEWS PROVIDED BY

Baltic Representative Office – Ixinium

Sep 08, 2021, 10:00 ET